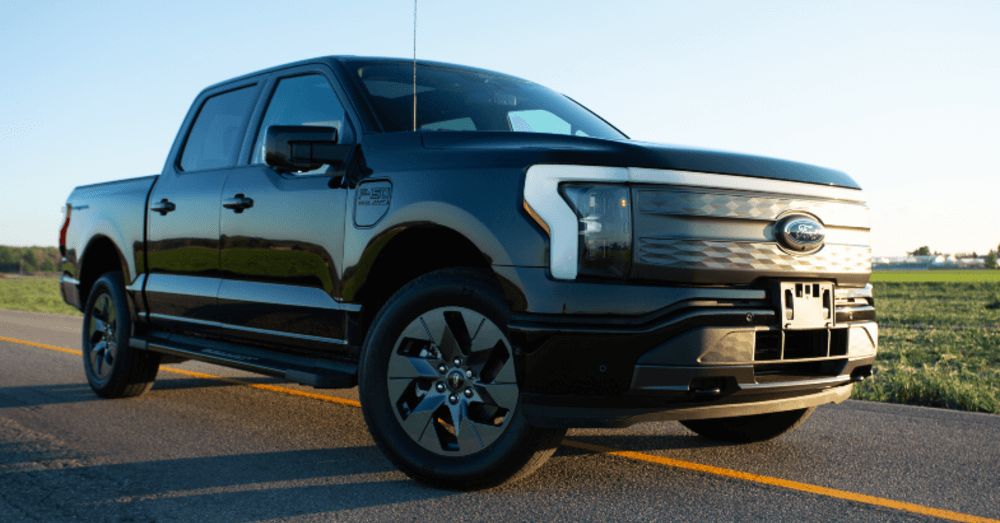

America’s favorite truck just went back to basics. Ford stopped making the all-electric F-150 Lightning this month, and the decision tells us everything about where electric trucks stand right now. What was supposed to transform the industry is becoming another lesson in reading the market wrong.

- Ford ended production of the all-electric F-150 Lightning in December 2024 after losing money on every single truck sold.

- The Lightning will return as an extended-range electric vehicle with a gas generator that keeps the battery charged for over 700 miles of driving.

- Sales never came close to Ford’s original target of 150,000 trucks annually, with the company moving only about 22,800 units in all of 2024.

What Went Wrong With the Lightning

Back in 2021, Ford announced the F-150 Lightning with serious fanfare. They promised a $40,000 starting price and positioned it as the truck that would finally bring electric power to mainstream America. But reality hit hard. By the time trucks actually reached dealers, that attractive price tag had vanished. Starting prices for 2025 models jumped to $55,000, with many configurations pushing into the $60,000 to $90,000 range.

Andrew Frick, president of Ford Blue and Ford Model e, put it bluntly during a call with reporters Monday. “American consumers are speaking clearly. They want the benefits of electrification like instant torque and mobile power, but they also demand affordability.” Ford’s math just didn’t work. Every Lightning that rolled off the assembly line lost money, even at those higher prices.

Walk onto any Ford dealership lot and you’d see the problem immediately. Lightning trucks sit right next to gas-powered F-150s that look nearly identical, offer similar equipment, and cost $10,000 to $15,000 less. For buyers shopping for trucks, choosing became pretty obvious. If you’re looking at a Used Ford F-150 on a dealer lot today, you’ll notice those gas models still dominate inventory.

The Numbers Don’t Lie

Ford originally planned to build up to 150,000 Lightnings per year. They never got close. Sales in 2024 totaled around 22,800 units. While Ford tried putting a positive spin on things by noting their Lightning sales doubled year-over-year in Q3 2024, that growth came from a very low baseline and still left them trailing both the Tesla Cybertruck and Rivian R1T in sales.

Production costs stayed stubbornly high. Manufacturing didn’t get cheaper as Ford had hoped. Promised economies of scale never materialized. Meanwhile, competition heated up with more electric truck options hitting the market, each one chipping away at the Lightning’s early lead.

Add in changing government policy and the picture gets even tougher. Federal tax credits of $7,500 that made EVs more affordable are under threat. New emissions and fuel economy standards that pushed automakers toward electric vehicles are being rolled back. Without those regulatory pressures, Ford can make more profitable gas and diesel trucks without penalty.

What’s Next for Electric F-150s

Don’t count Ford out of the electric truck game completely. Lightning nameplate will live on, but with a totally different setup. Next versions will be extended-range electric vehicles (EREVs) that use gas generators to keep batteries charged. Think of it like a plug-in hybrid on steroids. You get electric driving most of the time, but when batteries run low, a small gas engine kicks in to generate electricity and keep you moving for over 700 miles total range.

Ford hasn’t announced when this new Lightning will arrive or what it’ll cost. They’re also scrapping plans for a clean-sheet electric truck design that was supposed to fix all the original Lightning’s issues. Instead, Ford is putting money into smaller, cheaper EVs and that mid-size electric pickup they announced earlier this year.

Battery facilities in Kentucky that were supposed to make Lightning batteries? Getting retooled to make grid storage batteries instead. These massive battery systems help balance electrical grids by storing cheap electricity when wind and solar power are abundant, then releasing it during high-demand periods.

The Reality Check

This move isn’t happening in a vacuum. Ford is taking a staggering $19.5 billion hit to reshape its entire EV business strategy. That includes an $8.5 billion writedown of EV assets and $5.5 billion in cash charges spread through 2027. Those are numbers that show just how badly Ford miscalculated the electric truck market.

CEO Jim Farley calls this a “customer-driven shift,” and he’s not entirely wrong. Buyers want some electric features, like instant torque and the ability to power tools at a job site. But they’re not willing to pay $20,000 more for a truck that looks identical to the gas version sitting next to it, especially when towing and hauling needs still favor traditional engines.

Hybrid F-150s have been selling like crazy, up 64% year-over-year. That’s where customer demand actually lives right now. People want better fuel economy and some electric benefits, but they’re not ready to commit fully to batteries alone for their work trucks.

Making the Call on Electric Trucks

If you were holding out for an all-electric F-150, you’ve got about five seconds left to snag one from dealer inventory. After that, you’re waiting for the extended-range version with no clear timeline. For most truck buyers, this message is clear. Hybrids are here and proven. Full electric still has hurdles to clear.

Lightning wasn’t a bad truck. Owners generally loved the instant power, the built-in power outlets, and the smooth, quiet ride. It just hit the market at the wrong price point, at the wrong time, aimed at customers who weren’t quite ready to make the jump. Sometimes even the biggest names get it wrong.

Leave a Reply